Treasury Department Circular No. 230 - Regulations Governing Practice before the Internal Revenue Service (Revised June 12, 2014) : (IRS), Internal Revenue Service: Amazon.es: Libros

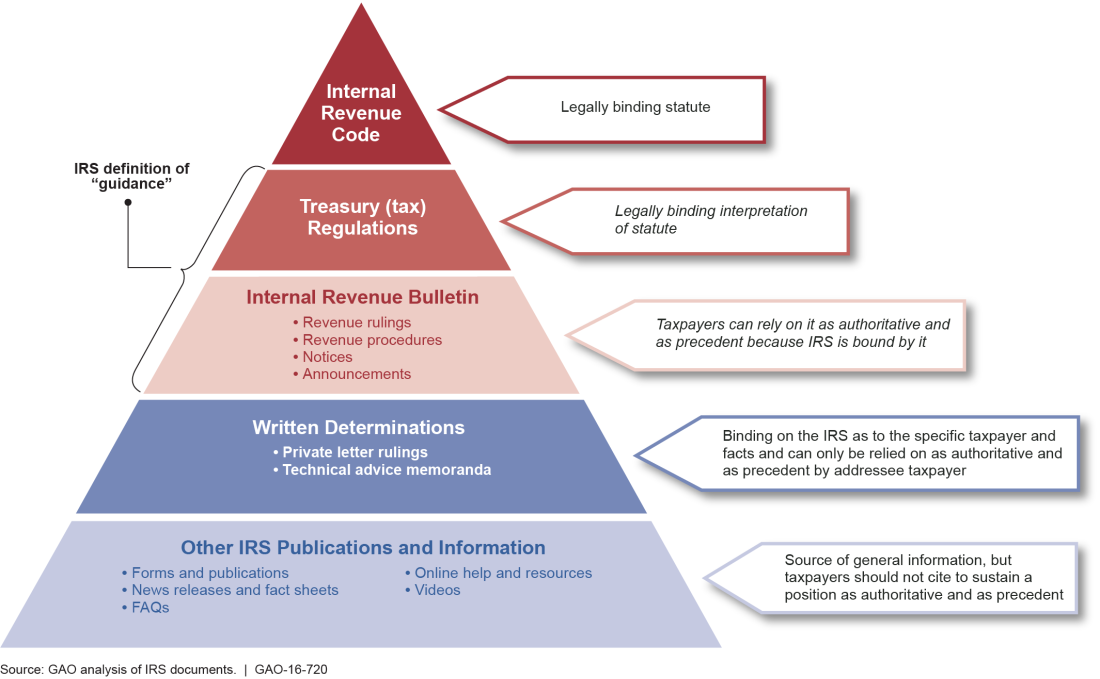

Treasury Regulations - Tax Law Research : Federal and Ohio - LibGuides at Franklin County Law Library

Guest Post by Coincu: IRS And Treasury Required To Issue Tax Regulations For Cryptocurrency Brokers | CoinMarketCap

Libro Code of Federal Regulations, Title 26 Internal Revenue 1. 301-1. 400, Revised as of April 1, 2022 (libro en Inglés), Office Of The Federal Register (U.S.), ISBN 9781636712109. Comprar en Buscalibre

IRS Second Set of Proposed Regulations: Investing In Qualified Opportunity Funds, April 2019 — NCSHA

:max_bytes(150000):strip_icc()/irs-pub-541.asp-final-6e6e0981090e40e6bf7d5c28bc9cd872.png)

:max_bytes(150000):strip_icc()/GettyImages-482855989-93236a8122dd4e94bd3a8ba43c5ac9a5.jpg)