CRR visuell: Die neuen EU-Vorschriften der Capital Requirements Regulation : Luz, Günther, Neus, Werner, Schaber, Mathias, Schneider, Peter, Wagner, Claus-Peter, Weber, Max: Amazon.co.uk: Books

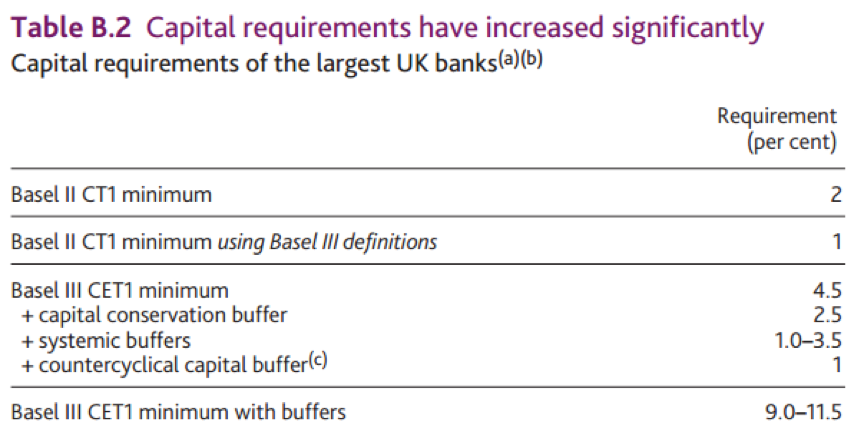

Are Bank Capital Requirements Really Ten Times Higher than Before the Crisis? — Adam Smith Institute

City of London calls on Bank of England to delay bank capital rules until mid-2025 | Financial Times

Page Compare: Regulation 575/2013/EU - Capital Requirements Regulation CRR (UK CRR as onshored by HM Treasury) (Retained EU Law) | Better Regulation

UK banks subject to highest Pillar 2 requirements among major European lenders | S&P Global Market Intelligence

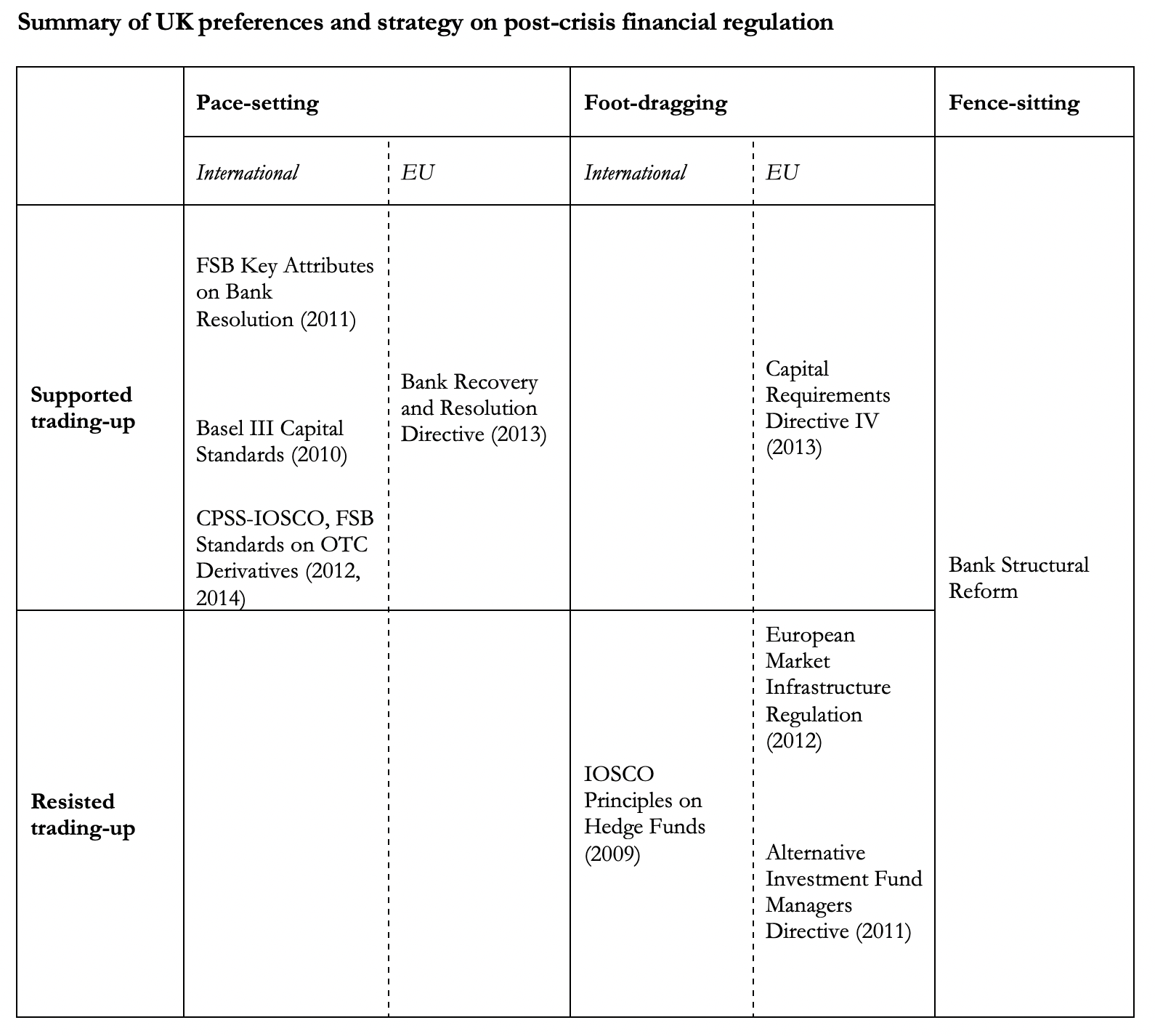

Multi-level financial regulation and domestic political economy: accounting for the UK's shifting regulatory outlook, from post-crisis reform to Brexit | British Politics and Policy at LSE

.png)